Introduction

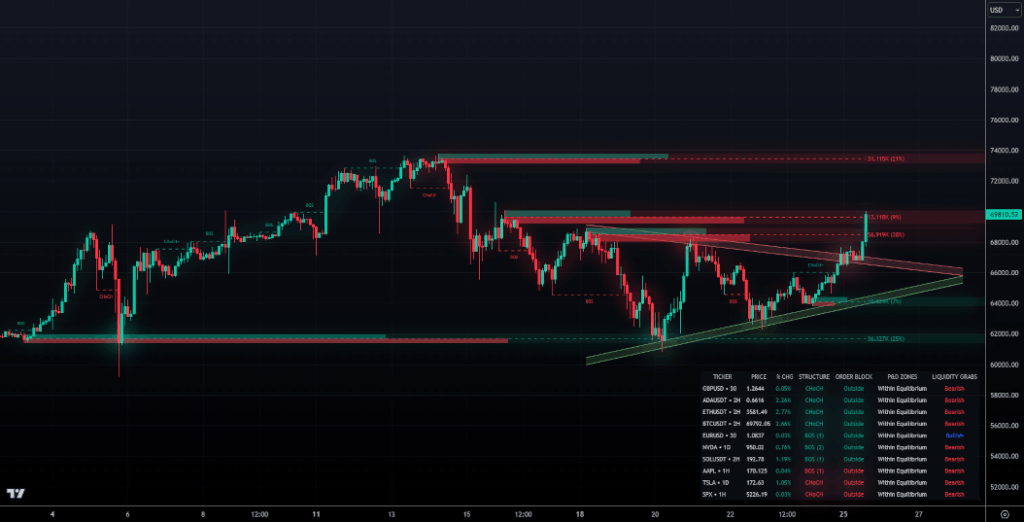

LuxAlgo’s Price Action Concepts (PAC) automates many elements of discretionary trading — marking structure shifts, premium/discount zones, liquidity, imbalances (FVGs), and order blocks — directly on TradingView.

Used well, PAC gives you a consistent framework for planning trades instead of manually redrawing levels every session. In this guide, we’ll break down exactly how to use LuxAlgo Price Action Concepts like a pro with a step-by-step workflow.

Affiliate Disclosure: This guide contains affiliate links. If you subscribe via these links, I may earn a commission at no extra cost to you. Trading involves risk; past performance doesn’t guarantee future results.

? Try LuxAlgo PAC here: https://luxalgo.com/?rfsn=7984439.6144b0

What Is Price Action Concepts?

PAC is an invite-only TradingView indicator from LuxAlgo that can display:

- Market Structure: swing vs. internal structure, BOS (Break of Structure), CHoCH (Change of Character), equal highs/lows.

- Premium/Equilibrium/Discount (PD) Zones: “expensive vs. fair vs. cheap” contextual zones.

- Liquidity Concepts: liquidity pools, grabs/sweeps around EQH/EQL.

- Imbalances / Fair Value Gaps (FVGs): areas where price may rebalance/mitigate.

- Order Blocks: with internal buy/sell activity readouts.

Everything is modular — you can enable only what you need for a cleaner chart.

How to Set It Up on TradingView

- Add PAC: In TradingView, go to Indicators → search “LuxAlgo Price Action Concepts” (invite-only). Ensure your TradingView username is linked in your LuxAlgo account.

- Open Settings: Click the indicator’s gear icon.

- Toggle Core Modules:

- Market Structure: enable BOS and CHoCH (optionally CHoCH+ for stricter confirmation).

- Premium/Discount: enable PD Zones to visualize Premium, Equilibrium, and Discount.

- Liquidity & Imbalances: enable FVG, Double/Inverse FVG, and Volume Imbalance as needed.

- Order Blocks: enable Order Blocks and Internal Activity for quality checks.

- Create Alerts (Optional): Set up alerts for specific PAC conditions, such as “BOS up on H1 AND price returns to FVG in Discount.”

A 3-Step Trading Workflow

1. Map on the Higher Timeframe (HTF)

Use D1/H4 to identify trend direction and nearby Supply/Demand areas. Note where price sits within PD zones — typically, look for long setups in Discount, short setups in Premium.

2. Wait for Structure + Liquidity Cues

Watch for BOS (trend continuation) or CHoCH (potential regime shift). Look for liquidity grabs around equal highs/lows, as these often precede directional moves.

3. Refine Entries on the Lower Timeframe (LTF)

Drop to M15–M5 to wait for a return into an FVG or nearby Order Block aligned with your HTF bias.

- Example (Long): After CHoCH up on H1, enter on an M15 pullback into a discount FVG overlapping a bullish OB.

- Stop Loss: Below the OB/FVG boundary or swing low defining structure.

- Targets: First at Equilibrium, then at the opposite PD zone or next HTF area.

Pro Tips

- Multi-Timeframe Logic: Map on D1/H4, trigger on M15/M5 to reduce false signals.

- Chart Clarity: Don’t overload with too many layers; use PD + Structure + (FVG or OB).

- FVG Context: Treat FVGs as value zones, not standalone signals.

- Order Block Quality: Ensure PAC’s internal activity matches trade direction.

- Alerts: Use “Once per bar close” to avoid intrabar noise.

Pros & Cons

Pros

- Combines structure, PD zones, liquidity, FVGs, and OBs in one tool.

- Highly configurable; works for scalpers to swing traders.

- Alert-friendly for semi-automation.

Cons

- Can overwhelm if all modules are enabled at once.

- Requires proper risk management and forward testing.

Pre-Trade Checklist

- HTF context: trend, nearest Supply/Demand, PD zone location.

- Structure: BOS or CHoCH aligned with bias.

- Liquidity: sweep/grab around EQH/EQL?

- Refinement: valid FVG or OB nearby, internal activity supportive.

- Execution plan: entry, stop, targets, risk % per trade.

Conclusion

When used with a top-down approach, LuxAlgo Price Action Concepts offers a clear, repeatable decision framework for any market. It won’t replace discipline, but it will keep your analysis consistent and efficient.

? Start your LuxAlgo PAC trial here: https://luxalgo.com/?rfsn=7984439.6144b0