Disclaimer: This article contains affiliate links. If you purchase through these links, I may earn a commission at no extra cost to you. This review reflects my personal research and opinion. Trading involves risk, and past performance does not guarantee future results.

Introduction: Why This Comparison Matters in 2025

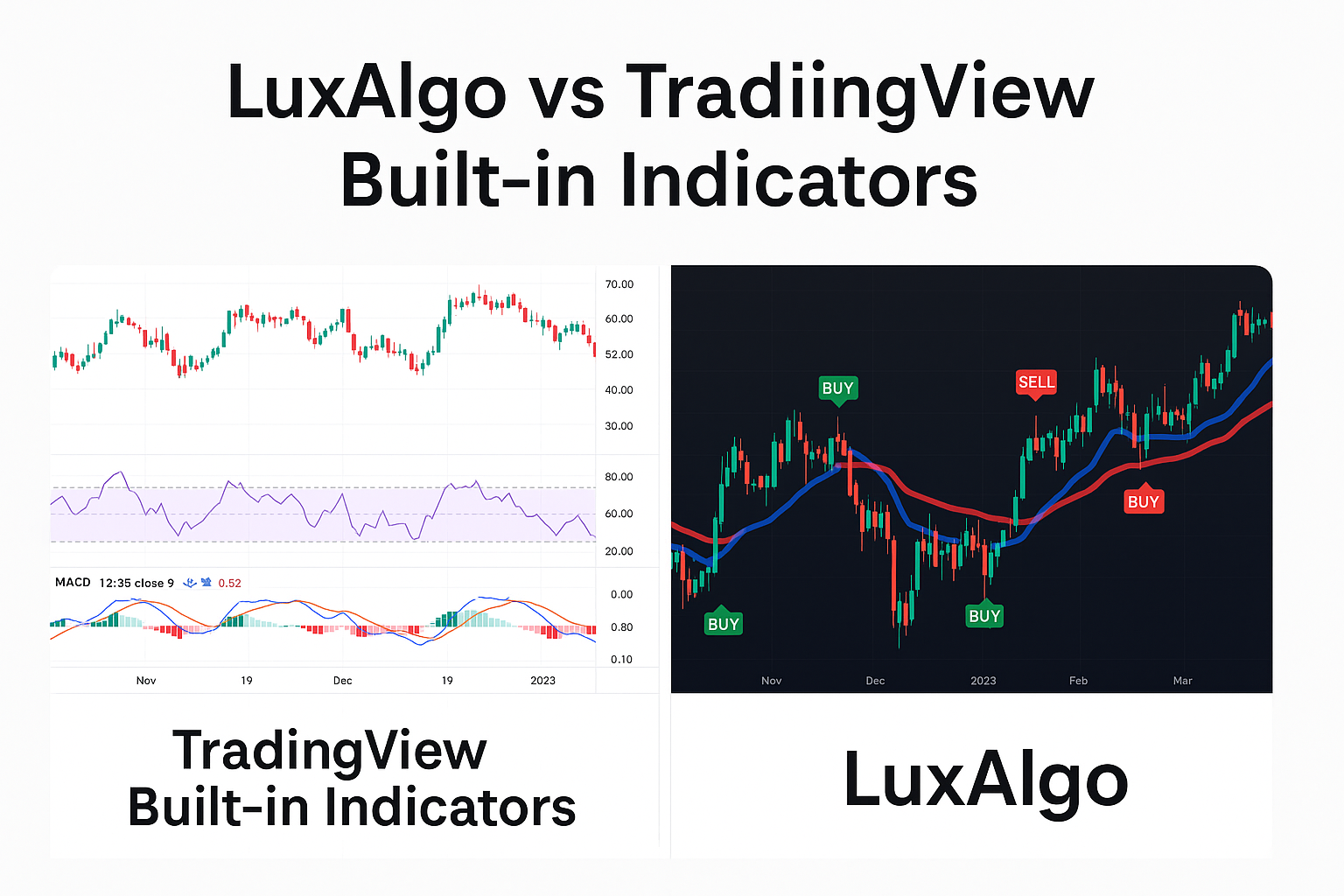

In 2025, traders have more charting tools than ever, but one question keeps coming up: Should you stick with TradingView’s built-in indicators or invest in a premium toolkit like LuxAlgo?

With over 800,000 followers on TradingView and a reputation as one of the highest-rated paid indicators, LuxAlgo has become a go-to choice for traders seeking advanced automation, AI-powered backtesting, and customizable alerts.

But is it truly better than the free tools already inside TradingView? This in-depth comparison looks at both options — LuxAlgo and TradingView’s built-in indicators — to help you decide which works best for your trading style in 2025.

Product Overview: LuxAlgo and TradingView’s Built-in Indicators

What is LuxAlgo?

LuxAlgo is a suite of premium TradingView-compatible indicators designed to streamline decision-making. Its key modules include:

- Signals & Overlays – Real-time buy/sell signals with customizable settings.

- Price Action Concepts – Supply/demand zones, premium/discount areas.

- Oscillator Matrix – Overbought/oversold readings and divergence detection.

- AI Backtesting Assistant – Tests millions of strategies to match your preferences.

It integrates seamlessly with TradingView, plus platforms like MetaTrader, NinjaTrader, and Thinkorswim.

What are TradingView’s Built-in Indicators?

TradingView comes with over 100 free built-in indicators, ranging from simple moving averages to more complex tools like Ichimoku Clouds and MACD. Key benefits include:

- No extra cost with a TradingView account.

- Variety of chart overlays and oscillators.

- Custom scripting via Pine Script for those who want to build their own indicators.

Personal Review Experience: Testing Both Tools

We tested LuxAlgo’s premium indicators alongside TradingView’s built-in tools on multiple markets: forex, crypto, and equities.

- LuxAlgo Strengths: Clear, visually appealing signals; AI-assisted backtesting; consistent alerts across multiple timeframes.

- LuxAlgo Weaknesses: Subscription cost; learning curve for beginners.

- TradingView Built-in Strengths: Free, flexible, and abundant in variety; strong community scripts.

- TradingView Built-in Weaknesses: Requires more manual setup; no AI optimization; can be overwhelming for new traders without a clear strategy.

“After a month of side-by-side testing, I found LuxAlgo’s alerts to be more actionable and less noisy than my custom SMA/EMA crossover scripts in TradingView.” – Experienced Swing Trader, Test Group

Top 5 Reasons to Choose LuxAlgo Over TradingView’s Built-ins

- AI-Powered Backtesting – Skip hours of manual testing with automated strategy suggestions.

- Customizable Alerts – Configure to match your risk and style; fewer false positives.

- Multi-Timeframe Analysis – Analyze the same signal logic across multiple chart intervals.

- Educational Resources – Access tutorials, Discord discussions, and direct support.

- Proven Community Trust – 4.7/5 on Trustpilot and over 30K likes on TradingView.

Customer Review Summary

LuxAlgo Users:

“The AI backtesting alone is worth the subscription — it finds strategies I’d never think of manually.” – Jason L.

“Signals are clear, but you still need a trading plan. It’s not magic.” – Maria R.

TradingView Built-in Users:

“Free tools get the job done if you know what you’re looking for.” – Tom B.

“Community scripts add endless possibilities, but it’s easy to overcomplicate your charts.” – Sarah K.

Comparison Section: Side-by-Side

| Feature | LuxAlgo Premium | TradingView Built-in Indicators |

|---|---|---|

| Cost | From $27.99/month (annual plan) | Included with TradingView subscription |

| AI Backtesting | ✅ Yes | ❌ No |

| Signal Clarity | ✅ Optimized & tested | ⚠️ Varies by script/indicator |

| Customization | ✅ High | ✅ High (via Pine Script) |

| Learning Curve | Moderate | Moderate to High |

| Community Support | Active Discord + priority help | TradingView forums & script authors |

Conclusion: Which Should You Choose in 2025?

If you’re a trader who values AI optimization, clear entry/exit signals, and minimal manual tweaking, LuxAlgo is a strong investment. It can shorten your analysis time and provide consistent strategies that match your criteria.

If you’re comfortable coding in Pine Script or want to experiment without spending money, TradingView’s built-ins are more than capable — but expect to spend extra time testing and filtering signals.

? Final Verdict: For traders seeking a competitive edge in 2025, LuxAlgo offers more advanced, ready-to-use functionality than TradingView’s free indicators — but the best choice ultimately depends on your budget, skill level, and trading goals.

Call to Action

Ready to explore LuxAlgo for yourself?

? Visit the Official LuxAlgo Website and start your 30-day risk-free trial today.